Short Story

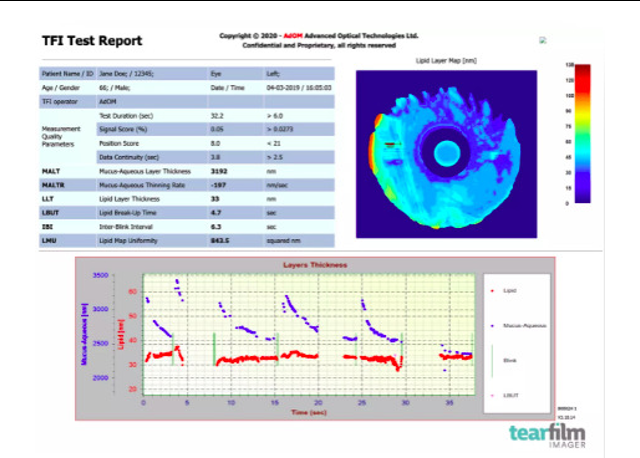

Annabella has developed a breast pump that mimics a baby’s natural sucking response and extracts more milk in a shorter amount of time. The Annabella is quiet and can be connected to the company’s “brain app,” which synchronizes the pump and allows users to see statistics and learn more about the pumping process. The Annabella pump is light, small, chargeable, and easy to travel with.

Anabella

$3,845,000.00

Pledged

1

Backers

Raised:

452.35%

Goal:

$850,000.00

By a a

6 Campaigns | 0 Loved campaigns